SMSF succession planning part 1 – getting started

Part 1 examines the key characteristics of a sound SMSF succession plan including planning for control of the fund to pass into trusted hands in the event of a member’s death or loss of capacity.

For many Australians, superannuation is a significant asset especially if an SMSF is involved. However, despite this, many do not plan ahead for what happens to their superannuation upon their loss of capacity or death.

We recommend that every SMSF member develops a succession plan, consistent with their other estate and succession plans, to ensure there is a well-considered and documented process in place to govern succession to control of their fund.

Failing to plan ahead can result in considerable uncertainty arising in the future with respect to the control of an SMSF and the ultimate fate of the member’s superannuation benefits. For instance, inadequate attention to succession planning could result in superannuation death benefits being paid otherwise than intended, and unnecessary costs and stresses arising for the family.

Key characteristics of good succession planning

SMSF succession planning broadly aims to accomplish the following outcomes:

- the right people gain control of the SMSF to ensure that superannuation benefits are paid as intended;

- the right people receive the intended proportion of SMSF money and assets; and

- outcomes are provided in a timely and legally effective manner, with minimal uncertainty and in as tax efficient manner as possible.

SMSFs are subject to some complex rules and are strictly regulated by the ATO with sizeable penalties that can be imposed for most breaches. Thus, expert advice should be considered when undertaking SMSF succession planning, especially as not all SMSFs will have governing rules that cover the right succession strategies.

Accordingly, there is no easy ‘one size fits all solution’ for SMSF succession. However, all plans should, at least:

- determine the person(s) who will occupy the office of trustee/director upon loss of capacity or death;

- ensure that the SMSF can continue to meet the definition of an SMSF under s 17A of the Superannuation Industry (Supervision) Act 1993 (Cth) (SISA);

- determine what each member’s wishes are for their superannuation benefits;

- determine to what extent each member’s wishes should be ‘locked in’ through the use of an automatically reversionary pension and/or a BDBN; and

- determine the tax profile of anticipated benefits payments.

Succession on loss of capacity — the role of attorneys

With the passage of time, there is a significant risk that some SMSF members may lose the capacity to administer their own affairs. In the absence of prior planning, this could result in major uncertainty and risk arising in relation to control of the SMSF. Having an EPoA in place can help overcome this problem, as an EPoA appointment is ‘enduring’, enabling a trusted person (ie, the member’s attorney under an EPoA) to continue to run the SMSF as their legal personal representative (LPR) in the event of loss of capacity.

It is strongly recommended that every SMSF member implement an EPoA as a part of their personal SMSF succession plan. It would not be an exaggeration to say that being an SMSF member without having an EPoA is a significant risk exposure.

Naturally, given the important responsibilities placed on an attorney, a member must trust their attorney to do the right thing by them. Only a trusted person should be nominated, and insofar as the member retains capacity, the EPoA should be subject to ongoing review to ensure its ongoing appropriateness.

Consideration should also be given as to whether the scope of the appointment should be general in nature (ie, a general financial power) or limited to the SMSF or to the SMSF trustee. For example, if the member wishes to preclude their attorney from exercising certain rights in relation to their member entitlements or making or revoking their BDBN, this should be expressly covered in their EPoA.

It should be noted that having an EPoA in place does not generally give effect to an intended appointment of the attorney as an SMSF trustee (or director of a body corporate that is trustee). An EPoA merely permits the member’s attorney to occupy the office of trustee or director of the corporate trustee to help satisfy the trustee-member rules in s 17A of the SISA. Thus, the attorney must still be appointed at the trustee-level at the appropriate time.

The appointment mechanism which facilitates an attorney (or other LPR) to step into the role of trustee/director is contained must be contained in the SMSF deed and the company’s constitution. For example, in the context of a corporate trustee, in the absence of other appointment provisions in the constitution, generally a majority of the company’s shareholders must exercise their voting rights to appoint a director.

Succession on death — the role of the executor as LPR

The death of a member is the other key succession planning risk that needs to be carefully considered.

Section 17A(3) of the SISA provides an exception to the trustee–member rules where a member has died. The exception in s 17A(3) provides that a fund does not fail to satisfy the basic conditions of the trustee–member rules by reason only that:

(a) a member of the fund has died and the [LPR] of the member is a trustee of the fund or a director of a body corporate that is the trustee of the fund, in place of the member, during the period:

(i) beginning when the member of the fund died; and

(ii) ending when death benefits commence to be payable in respect of the member of the fund.

This exception permits an LPR of a deceased member (eg, an executor of a deceased person’s estate) to be a trustee/director in place of a deceased member until the member’s death benefits commence to be payable.

However, this provision does not result in an LPR becoming a trustee/director. For example, for s 17A(3) to apply, an LPR must actually be appointed as either:

- a director of the corporate trustee pursuant to the constitution of the company; or

- an individual trustee pursuant to the governing rules of the fund.

This has been confirmed in numerous cases, including in Ioppolo v Conti [2013] WASC 389, Ioppolo v Conti [2015] WASCA 45 and implicitly in Wooster v Morris [2013] VSC 594. In Ioppolo v Conti [2013] WASC 389, Master Sanderson described the operation of s 17A(3) as follows ([20]):

…The mechanism of the section is tolerably clear. Section 17A(3) allows for the appointment of an executor as a trustee of the fund but does not in its terms require such an appointment. …

These cases broadly confirm that a deceased person’s LPR (ie, their executor) will not generally step into the role of an SMSF trustee/director automatically upon a member’s death. Broadly, it depends on the provisions of the SMSF deed and the company constitution (most SMSF deeds and constitutions do not have a mechanism for this to occur) and whether there are other legal documents in place to ensure this occurs.

The role of the Corporations Act 2001 (Cth) in respect of corporate trustees

Section 201F of the Corporations Act 2001 (Cth) empowers the personal representatives of a sole director and sole shareholder in a private company to appoint new directors for the company on the death or loss of mental capacity of the principal (ie, the sole director/shareholder).

Thus, if an SMSF was a sole member who is also the sole director/shareholder of the corporate trustee, s 201F can assist in relation to the member’s LPR exercising powers to take control of the SMSF trustee after their death (or loss of legal capacity).

However, it is important to understand the limitation of this provision. For instance, s 201F cannot assist where an SMSF member has died and SMSF trustee company has more than one director or shareholder, or where the shareholder is a person other than the sole director who has died.

Accordingly, relying on s 201F is not a sound strategy in many cases.

Successor directors

By ensuring that the fund’s corporate trustee has an appropriate company constitution that contains successor director provisions, it is possible to plan for smooth succession to the role of a director in advance while also overcoming limitations that apply in respect of:

- appointing a new director via the usual rules in the corporate trustee’s constitution (eg, by majority shareholder vote); or

- the limited flexibility in s 201F of the Corporations Act 2001 (Cth).

Making a successor director nomination allows a director (ie, the principal director making a nomination in accordance with an appropriately drafted constitution) to nominate a person to automatically step into their shoes immediately upon their loss of capacity, death or a specified event occurring.

The successor director strategy is designed to work in conjunction with a member’s overall estate and succession plan to enable an attorney appointed under an EPoA or an executor of a deceased member’s estate to be automatically appointed as a director without any further steps involved.

Naturally, a successor director strategy relies on the right paperwork being in place, including the right constitution and related successor director nomination form.

Conclusions

Forward planning supported by the right documents is required for smooth and effective SMSF succession planning.

Expert advice should be sought in relation to formulating and implementing an appropriate SMSF succession plan.

Stay tuned for Part 2 in this multi-part series on SMSF succession planning which will cover the role of binding death benefit nominations.

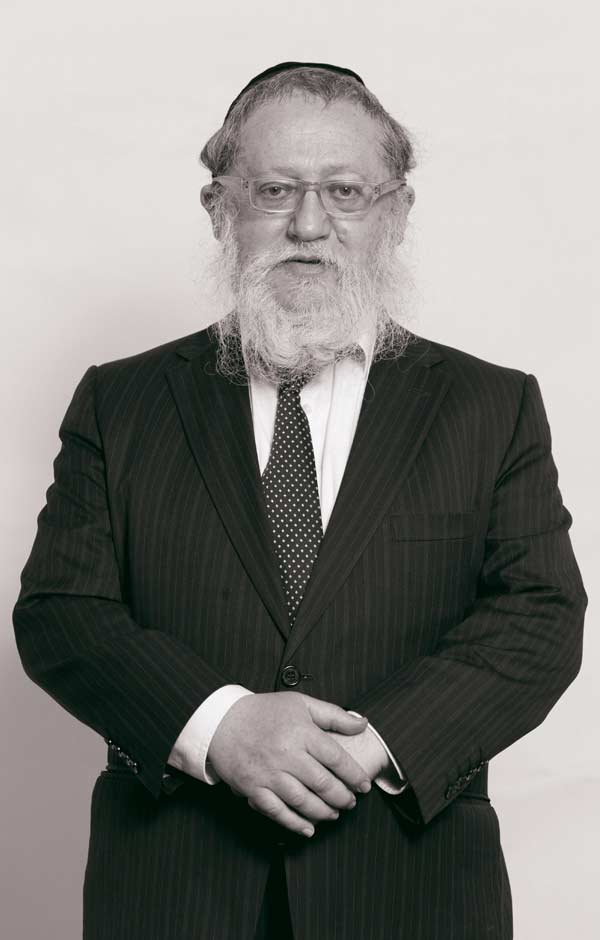

By William Fettes and Daniel Butler – DBA Lawyers

October 30 2024

smsfadviser.com